In 2024, it is expected that $600 trillion of Real-World Assets(RWAs) like stocks, derivatives, fine wines, paintings, real-estate, movies and more will be tokenized for the first time. The mammoth size of RWAS will require the right technology infrastructure that is fast, secure, scalable, transparent, and verifiable so that they enjoy higher liquidity and trade for sustainability.

Blockchains are shared distributed ledgers that simplify accountability and verifiability. It is expected that 10% of the Global GDP shall move to blockchains because asset tokenization will exceed $16 trillion by 2030. Hence, it wouldn’t be an understatement to say that RWAs will be the bridge for blockchains to enjoy massive supremacy in the forthcoming years. Even a small RWA project like Landshare is leading the way toward BNB chain adoption. In this blog, we shall see key problems RWA will face post their launch in 2024 and how blockchains will help solve the same to experience massive explosion.

Top Problems RWAs Will Face Requiring Decentralized Solutions

1. An Information Bridge

RWAs will have to relay over 10.8B + data points on chain for making the ecosystem work efficiently. Such a massive data intake from a single source could trigger a major point of failure. Hence, the need for L1s will arise that can provide real-time data feeds to secure the ecosystem.

2. Enabling Interoperability

As RWAs grow, they will need to be interoperable with its other partner ecosystem for experiencing very high liquidity. In this regard, the need for blockchain solutions will arise which are easily interoperable with the partner ecosystem to fulfill the demand.

3. Realtime Feeds

RWAs will be operating across a wider financial space. As a result, they will need quicker validation to avoid another 2008 like crisis. Blockchains are allowing access to quick data feeds to avoid mis management. One of the companies in Hong Kong, Arta Tech Fin is using a decentralized computing platform to keep a track of their tokenized funds. Investors can verify and validate through blockchains the NAV of the assets every moment to provide complete transparency.

Top L1 Blockchains That Could Help RWAs Scale

1. Elysium

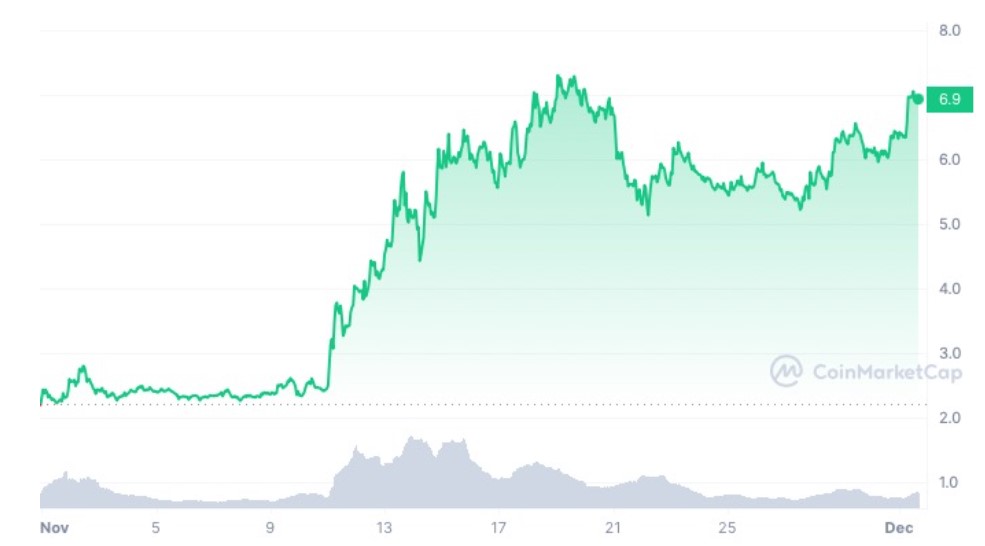

In contrast to other L1 blockchains, Elysium blockchains show true decentralization and not just any pseudo promise. For the RWAs sector to grow, they cannot rely on a technology stack which is heavily centralized via a few validator sets. Elysium has been building solutions overcoming the sharding point of failures. For example, instead of keeping all the data on a single chain, Elysium improvises by launching separate chains with their own tokens and use-cases to scale in parallel. As a result, projects built on top of Elysium experience infinite scalability. It is also expected that Elysium will be the home of all other Metaverse projects. In the last 1 year, PYR, the native token of the Elysium blockchain has shown a massive jump.

In 2024, Elysium can supercharge the RWAs space by allowing them to scale horizontally as per their changing use-cases while remaining in a common ecosystem which is extremely interoperable with other blockchains. TechNewsLeader has predicted that PYR token can reach as high as $11.58 by the end of 2023.

2. Celestia

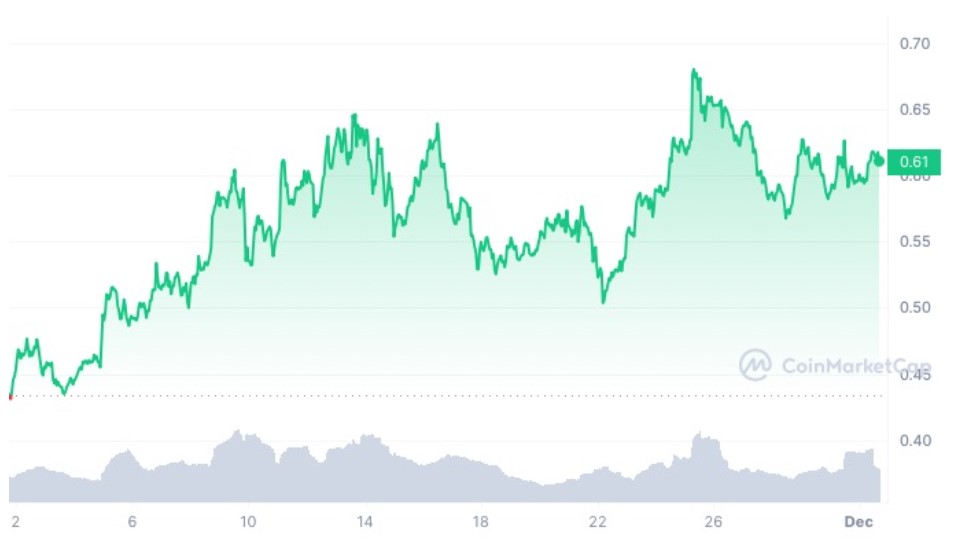

Celestia is launching with a modular framework; where, instead of the consensus, execution, and data layer dwelling on a common ecosystem, they can be divided to provide infinite scalability to applications running on top of it. In addition to this, Celestia allows applications to develop and launch their own blockchains with their own Execution Layer(EA); however, using the ecosystem of Celestia for Data Availability(DA).

In this way, RWAs oriented use-cases can develop their own standalone blockchains and use Celestia for DA while handling settlement on their own layer. Recently Optimism has partnered with Celestia which has opened the door for other ZKP based L2s to use Celestia as a preferred L1 layer for DA. In the past 1 year, Celestia has shown outstanding performance jumping from $2 to $6 at the time of writing. TechNewsLeader predicts that Celestia will be around $10 by the end of 2024.

3. Sui

SUI blockchain uses parallel transaction execution where instead of going for one transaction after another, all the transcations can be processed at once, which gives very high finality and scalability to applications developed on top of the blockchain. At the moment, the RWAs segment seeks near infinite scalability. SUI promises a whopping 120,000 transactions per second, which is way higher than Solana’s 4000 TPS and Ethereum’s 30 TPS. In addition to this, SUI also provides a hybrid solution of processing transcations where you can categorize them into simple and complex transactions.

This is very effective from the perspective of RWAs because for settlements, RWAs can use instant finality when sending tokens from one account to another. Whereas, in case of complex transcations on RWAs like ownership and validation, the complex Narwhal and Bullshark consensus platforms shall be used that uses DAG for verification. At the time of writing, a way over 10 projects are active on the SUI Network and its token has also shown immense potential in the last 1 month exploding by nearly 40%.

Conclusion

Most people have missed Solana, Ethereum, Avax which ultimately became their regret odyssey. With that said in 2024, these coins are probable L1’s to be your next Solana, Avax and ETH moment riding on RWAs. So, if you want to build a good portfolio with a promise of higher returns in 2024, these L1s are a perfect choice but it is always advisable to DYOR before investing in cryptocurrencies due to their extreme volatility.