Reports have suggested that by 2030, asset tokenization will be a $10 trillion economy and much of that will be influenced by the Metaverse. So, the narrative that Metaverse and NFTs are dead doesn’t hold good anymore. Why? Because, 97% of the gaming companies are innovating in one way or the other to improve the gameplay and they are implementing NFTs which can supercharge this experience.

Read Reports by Rolandberger.com

On that note, if you missed investing in some of the best NFT projects that made 10x to 200x returns, the boat hasn’t sailed yet and you can still catch it by capitalizing on the following trends and the projects that support these trends. So, brace up for the top NFT trends which shall help you define your portfolio 2024.

Top NFT Trends To Keep In Your Investment Radar in 2024

Rare & Tangible NFTs

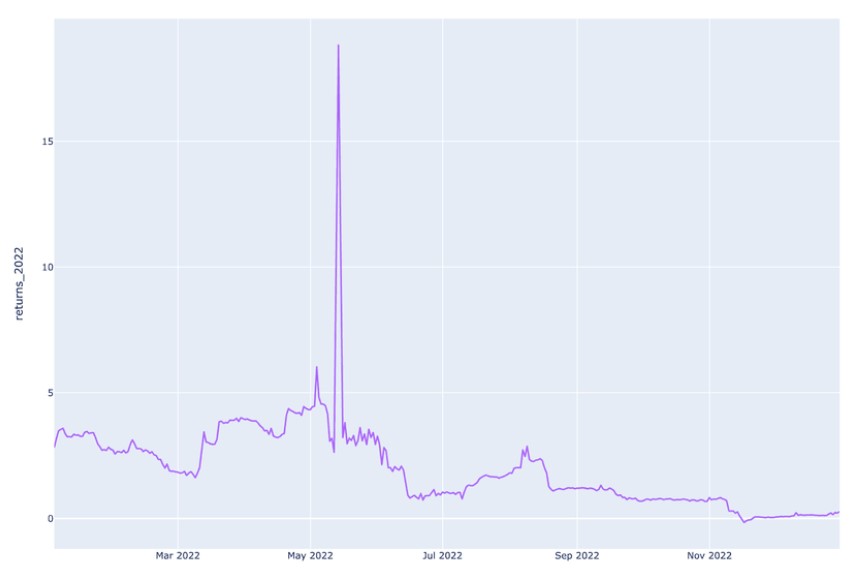

The demand for rare NFTs will not stop in 2024 because as per statistics while the NFT market shrunk to $3.7 billion from at the start of the year, what’s intriguing to note is that some of the NFTs like Azuki, Pudgy Penguins, and Degen Toonz booked a record 113.89%, 260%, and 204%, respectively. The 2024 market will be mirroring what we already saw in 2022. In 2022, Yuga LABS dominated the NFT marketplace with a whopping 67% share. But Yuga LABS dipped post that, as evident from the graph below.

And you have reasons to blame because they failed to mix and merge with the Metaverse which VulcanForged is doing through their Oculus and Tartarus NFT project. For the first time, the space is going to embrace a VR powered NEFT, which certainly roots the narrative stronger for an explosion in 2024. Investors can also use the rarity -NEFT-tools-tracker to pick and track the best NFT projects that shall leave no stones unturned to take the portfolio to the next level in 2024.

RWA NFTs

Tangibility will be another key segment to watch out for while undertaking the NFT investments. As we have already mentioned at the beginning of the piece that asset tokenization will be going mainstream; hence, it will supercharge the demand for those NFTs that derive value from real-world use-cases like event based NFTs, real-estate and artwork NFTs. So, if you are planning to build a portfolio, make sure that you have included Tangible and RWA NFTs in your portfolio because they will be the next big thing to watch out for in 2024. What makes us say that? The Tokenized US Treasury market has grown by 600% which has supercharged supporting L1’s layers launching these NFT marketplaces.

So, if you are either choosing those blockchains that support launching these tokenized projects or launching their own NFT projects, they are most likely to experience the push.

So far, Ethereum, Solana, Polygon and Stellar have provided the much needed support for RWA NFT marketplaces to rise and shine; but they are in one way or the other facing imminent centralization issues with respect to node validators. In this regard, emerging blockchains like Elysium which do not just introduce a supportive L1 layer but also provide a comprehensive ecosystem where you can see the power of AI, Metaverse, and game potential leave a mark will have considerable impact. Hence, choosing RWA NFTs will also help you build a strong NFT portfolio of 2024.

Loyalty NFTs

Loyalty NFTs will also be of great value to the loyalty NFT bearer where they can use these NFTs to receive special discounts and offers or get dividends as well from the companies launching these NFTs. SalesForce, StarBucks and Amazon have already enrolled for this initiative and these NFTs will also be linked to fashion and crypto gaming that will have the potential to create a ripple-effect to supercharge its related sectors.

Conclusion

Though we have seen the narrative that the NFT market is a bubble, in reality, 2024 will be a transformative year for the NFT market because we shall see their impact in the metaverse fashion and real-estate purchases. With that said, it will always be an ideal choice to diversify your portfolio with NFTs.