During the last bull-run of 2020-21, DeFi was the force multiplier enabling the crypto market to reach a staggering $3.1 T in market cap allowing Bitcoin and Ethereum to touch new ATHs. What’s intriguing to note here is that DeFi was very niche oriented, touching upon assets that dwelled within the crypto space. Despite that, the market momentum was parabolic.

Contrasting that with a technology which could bring $379.7 trillion to crypto, where would the market cap go. Even if we are settling for a humble 1% to 5% of the $397 T valuation entering the crypto market, the outcomes will be superficial. Courtesy to RWAs or Real World Assets because they have already triggered the script of the new bull run with their humble start of $6 B in TVL in just over a few months of its inception. In this blog, we shall see why RWAs are becoming the top choice for investors in 2024.

Top Reasons Investors are Bullish on RWAs

1. Fractionalization

Fractionalization is going to change how we look at assets. For example, right now, the real-estate market is completely illiquid. To put that into perspective, you cannot think of investing in an off-shore property if you have just $50 in your bank. Tokenization of RWAs has changed that for the better now. Projects like Landshare not just simply invest in real-estate through fractionization but also help you enjoy compounding effects while undertaking such investments.

For example, not just you can invest $100 to buy a property share, but rent that NFTs across diverse liquidity pools to extract additional value. Landshare has termed that as automated compounding where if you have $10,000 to invest in real-estate, it doesn’t simply 4X and 5X the yield to say $50,000. Rather, you can invest their governance and liquidity tokens to multiply the yields to even 20x to 50x which motivates more people to explore fractionalization of assets to enjoy its long term trade-offs.

2. Bond Yields Reduction

For the first time, the Bond Yields have fallen below 4% in the US. As a result, investors are pulling away their investments from the bonds and they are investing on platforms which are building on top of the RWAs for higher returns. Landshare has given 7% to 9% returns on RWA staking. So, ideally trillion of dollars in real-estate, stocks, bonds, arts and others could be pumped into RWAs allowing investors to mint higher returns in comparison to investing in bonds. So, it wouldn’t be an understatement to say that RWAs could usurp the bond market in the coming months considering the returns they are generating at the moment.

3. Tokenized Funds

Private Equity Funds market cap stands at a whopping $7 T. But, they are not easily accessible by the general public due to regulatory and other challenges.. As a result, general investors are devoid of 15% to 18% of returns that happen during mergers and acquisitions. JP Morgan and Apollo Global Management have introduced asset tokenization that allows the general public to enjoy the trade-off.

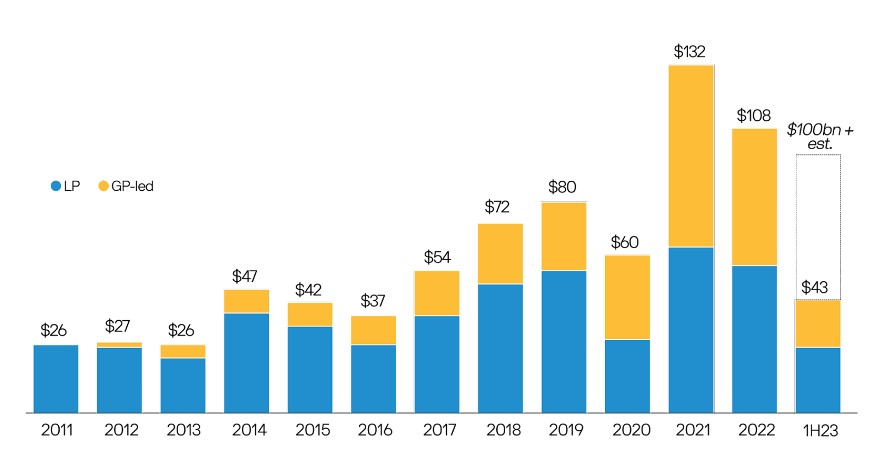

As a result, for the first time, we might see more participation of the commoners happening in the private equity funds which could ideally change the previous scenario as demonstrated by this chart. In this way, for the first time, Private Equity investors will be getting the chance to balance their Private Equity Portfolio and we might see the scenario of GP-or General Purpose investment changing with time where more people will participate in these funds through asset tokenization happening on-chain sans intermediaries.

4. Expansion to Other Segments

RWAs also allow other asset classes which have remained inaccessible during lending and borrowing to stimulate the financial sector. For example, you can use additional bonds, yields and certificates as a pledge to expand liquidity. Some of the banks like HVB are already doing the same where they are providing credible loan bonds with interest to MakerDAO. Maker DAO would mint DAI against such RWA(Loans) to extend the credit line to banks. In this way, banks can increase their credit lending capacity by manifolds and increase their potential to earn more through interest when borrowers approach them for loans. The CEO of BlackRock, Larry Fink says, “the next generation for markets, the next generation for securities, will be tokenization of securities.”

5. Easy Accessible Loans

Absence of inclusivity of the collaterals have made loans complex for the masses. To put that into perspective, could you use NBA Signed Cards or artworks to receive loans. Apparently, it is not possible in the real world banking system. RWAs are going to bridge that gap where users can bring the RWAs as a collateral in any form to receive loans. In economies like Asia, Latin America and Africa, where credit facilities are broken and niche based, RWAs can supercharge the possibility of businesses with assets that are not accepted by banks as mortgages to be used in tokenized forms for lending and borrowings.

Conclusion

The long run efficacies of RWAs couldn’t be expressed in numbers at the moment because we have just become acquainted with this new concept. Like in 2020-21, DeFi was making headlines with new concepts of yield farming, liquidity mining and flash loans, RWAs have brought more avenues to participate and gain exposure to an untapped market with immense potential. Only time will tell how the space will accept RWAs, but judging by the present momentum, it wouldn’t be an understatement to say that RWAs have started strongly nonetheless.